Alternative investments are having a great year – due in part to their attractiveness in times of volatility, and also to a few regulatory adjustments courtesy of the SEC and DOL.

Regardless of why, it’s clear that the marketplace for alternative investments is evolving to the investor’s advantage in several important ways. Studies produced by three alternative investment leaders help shine a light on the recent shift and provide valuable insights into investor behavior.

Alternative Investment Interest Up During Pandemic

iCapital’s Advisor Pulse Survey – which covers RIAs, family offices, private banks and qualified purchasers – points to increased interest in alternatives like private equity, private credit and hedge funds in today’s uncertain environment. Servicing more than $46.6 billion in invested capital across more than 100,000 underlying accounts, iCapital Network’s tech-enabled services look to help asset managers and banks streamline and scale their business operations.

Survey participants reported that 34% more investors were thinking about investing in an alternative strategy than six months before. Another 50% said they were also more likely to favor private equity today versus six months ago. Assets allocated to private equity and private credit were among the most favored overweights.

The survey found that the primary motive for considering alternatives is “volatility.” However, while 75% of participants said they saw “volatility ahead for the foreseeable future,” another 70% said they were more interested in “taking advantage of market dislocation to improve client outcomes.”

To illustrate the risk and return advantages of alternative allocations, iCapital published an analysis in June 2020 that found adding a 20% private equity allocation to a traditional 60/40 portfolio blend has historically enhanced return while mitigating risk.

WHAT ASSET MANAGERS ARE DOING WELL: iCapital

Powerful client-friendly illustrations

A quarter century of history tracked by iCapital provides powerful, real-life examples of the boost private equity can provide.

Extensive insights add clarity, depth to alt sector understanding

iCapital’s library of materials helps both financial advisors and investors to sharpen their alt knowledge through primers on private equity and value creation, hedge fund essentials and emerging alternative sectors like Health Care Royalty & Credit Investing.

To Attract Retail Investors, More Communications Needed

The trend of retail investors seeking alternative sources of returns that can offer diversification from traditional markets will be a significant force for change over the next five years, says global alternative investment research firm Preqin.

Among alternative fund managers polled by Preqin, 35% expect retail investors to account for a larger proportion of their AUM over the next five years.

According to Preqin, “To capitalize on any increase in ‘retailization’ in private markets, fund managers will need to add more customer-centric capabilities, such as more frequent reporting.”

Private market opportunities that were once only accessible to accredited investors are increasingly opening up to retail market participation, thanks in large part to the SEC expanding the definition of “accredited investor” in August.

According to alternative investment research firm Preqin, the SEC expects the total pool of individual investable assets to hit $106 trillion in 2025 (up from $70 trillion in 2018).

The retail theme for alternatives also got a “thumbs up” from the DOL in June. The DOL, which governs 401(k) retirement accounts, clarified that under federal law, defined contributions and pension plan fiduciaries can incorporate certain private equity strategies into diversified investment options like target-date funds.

WHAT ASSET MANAGERS ARE DOING WELL: PREQIN

Confidently look ahead to 2025

Preqin research teams know what it means to take the long view. Their ambitious microsite, The Future of Alternatives 2025, sketches out a wide variety of scenarios on a sector-by-sector basis. The site shows how they expect a variety of megatrends like big data, diversity and the pandemic to impact the alternative investment universe.

Strong social media presence spreads research far and wide

Preqin makes accessing their research easy and convenient across Instagram, Twitter, YouTube – and especially LinkedIn.

A Traditional Idea Becomes a Core Allocation

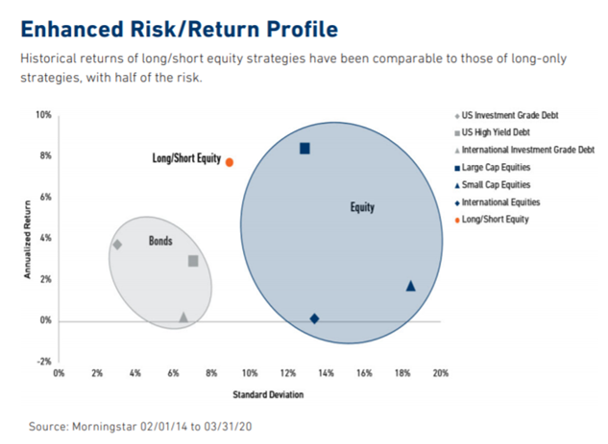

Alternative asset manager 361Capital has been a long-time advocate for long/short strategies. In their recent study, “The New Allocation: Long/Short Equity,” they explain why long/short equity strategies are ideal for the current climate.

“With uncertain equity markets, the potential for subdued-to-negative economic growth looming, and a bleak outlook for fixed income, advisors are challenged to rethink foundational portfolio elements—which means seeking out strategies that bolster the core going forward. Long/short equity strategies have come close to matching the performance of equities with a lower level of volatility than the traditional portfolio blend and with smaller drawdowns.”

WHAT ASSET MANAGERS ARE DOING WELL: 361 Capital

Up-to-the-minute weekly blog posts

361 Capital’s market commentary is doing a good job keeping up with many of the latest alternative asset management developments in the marketplace – with a special focus on market sectors that may provide fertile ground for private-equity participation.

Colorful, client-friendly presentation slides

Want to make the case that traditional markets are too expensive? How about how alternatives have performed relative to other investments? Need to show how managed futures diversify a portfolio? 361 Capital has the slides you need to build a compelling presentation deck across a broad range of categories.

With alternative demand increasing, a proven track record for resilience in tempering the impact of volatility, greater retail interest and long/short strategies for the core of a portfolio, the alternative investment story looks primed for the telling in 2021. And a growing number of platforms, asset managers and research specialists are more determined than ever to get it told.

Would you like to receive the latest insights on how asset managers and advisors are communicating with their audiences? Follow us on LinkedIn so you’ll never miss an update.